Revolutionizing Banking Accessibility in Japan

Design Systems Lead Jan 2021 – Present

Link

www.gigabank.jp

ios app

android app

GIG-A, the Estonian/Japanese fintech startup, is dedicated to revolutionizing banking services for foreign workers in Japan, prioritizing accessibility and simplicity. GIG-A partnered with UI Bank to provide users with account opening service.

As the sole designer, embarked on the journey to design the most seamless digital banking experience for foreigners in Japan.

The Problem

In Japan, a nation grappling with a declining birthrate and an aging population, foreign workers have emerged as a crucial workforce segment, with their numbers reaching an all-time high of 1,727,221 by the end of October 2021. Despite their growing importance, these individuals face significant barriers in accessing fundamental financial services, a cornerstone of daily life and economic integration.

The banking system, traditionally designed around the concept of lifelong employment, does not accommodate the varied and often non-traditional employment patterns of foreign workers, including gig workers and freelancers. This systemic rigidity, coupled with language barriers and a banking focus away from retail services, leaves many foreign workers underbanked and financially underserved.

In Japan, only 3 out of 114 banks offer online banking services in English, presenting challenges for foreigners due to stringent requirements. The level of retail banking services available to foreigners often feels outdated, typically including basic offerings like a bank account, bank book, and cash card, reminiscent of the 1980s.

The lack of accessible financial services for foreign workers not only hinders their ability to engage in basic financial activities, such as saving, sending remittances, and accessing credit, but also affects their overall integration into Japanese society. Moreover, it contributes to a broader issue of financial exclusion, affecting approximately 20 million underbanked individuals in Japan. The banking industry’s reluctance to adapt to the needs of this demographic exacerbates the problem, limiting the potential for economic growth and cultural integration.

Objective

Our vision was clear—to simplify banking for individuals from diverse backgrounds and to create a unique digital customer experience, accommodating to the needs of foreign workers in Japan.

This involves creating banking solutions that are accessible, user-friendly, and cognizant of the diverse financial needs and employment situations of this group. The envisioned outcome is a banking system that not only supports the financial well-being of foreign workers but also fosters their long-term integration and contribution to the Japanese economy.

Understanding the Challenges

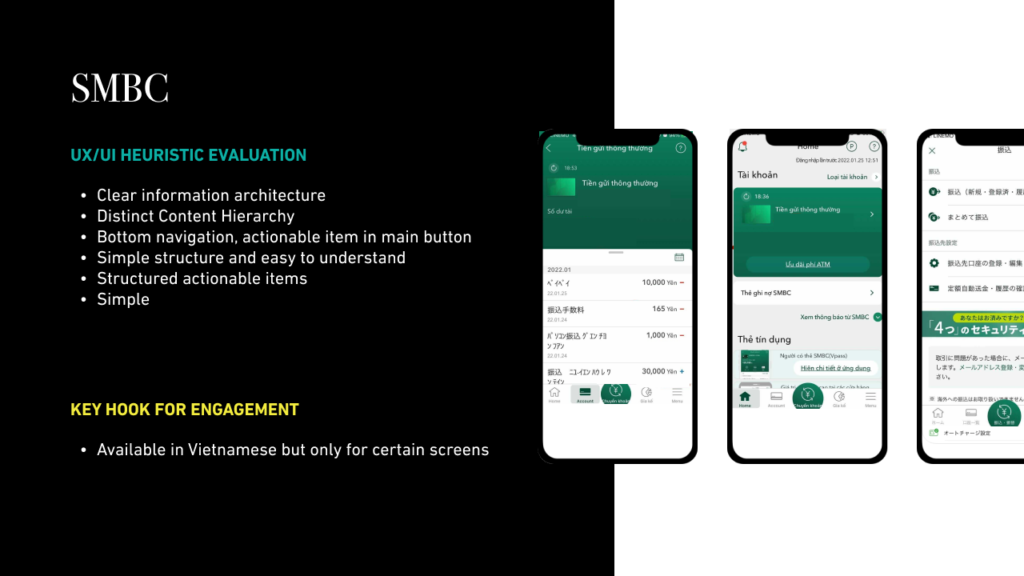

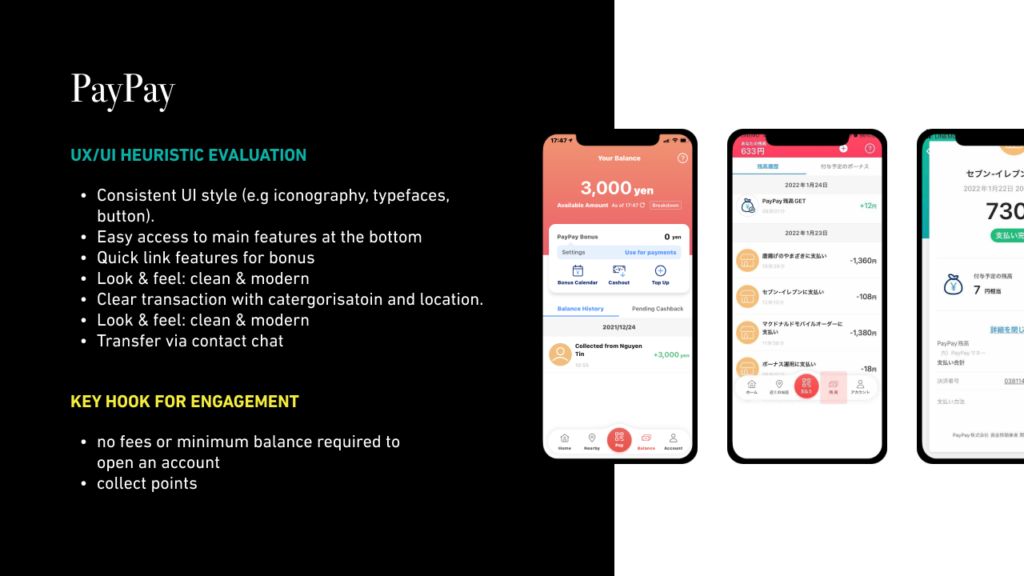

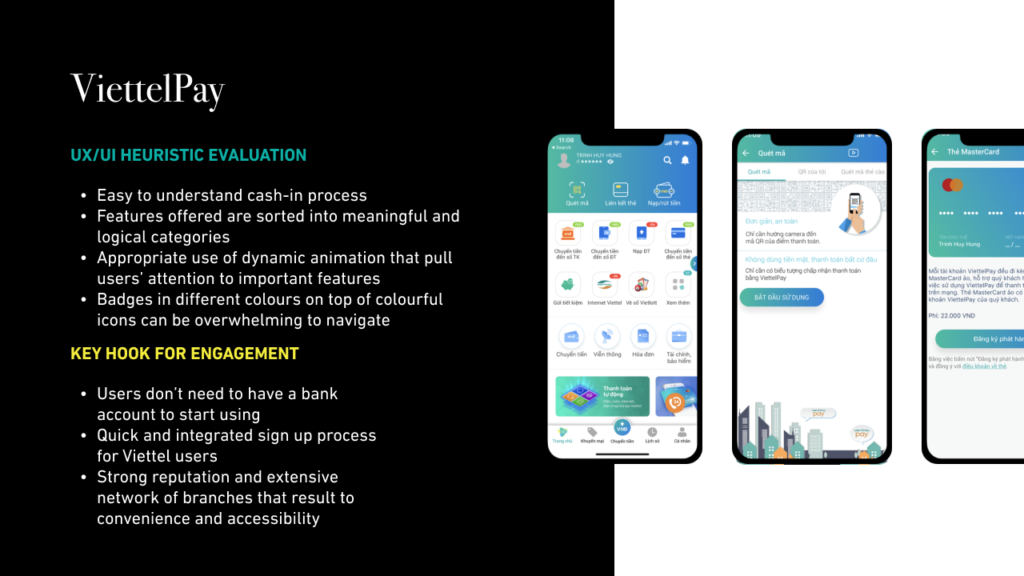

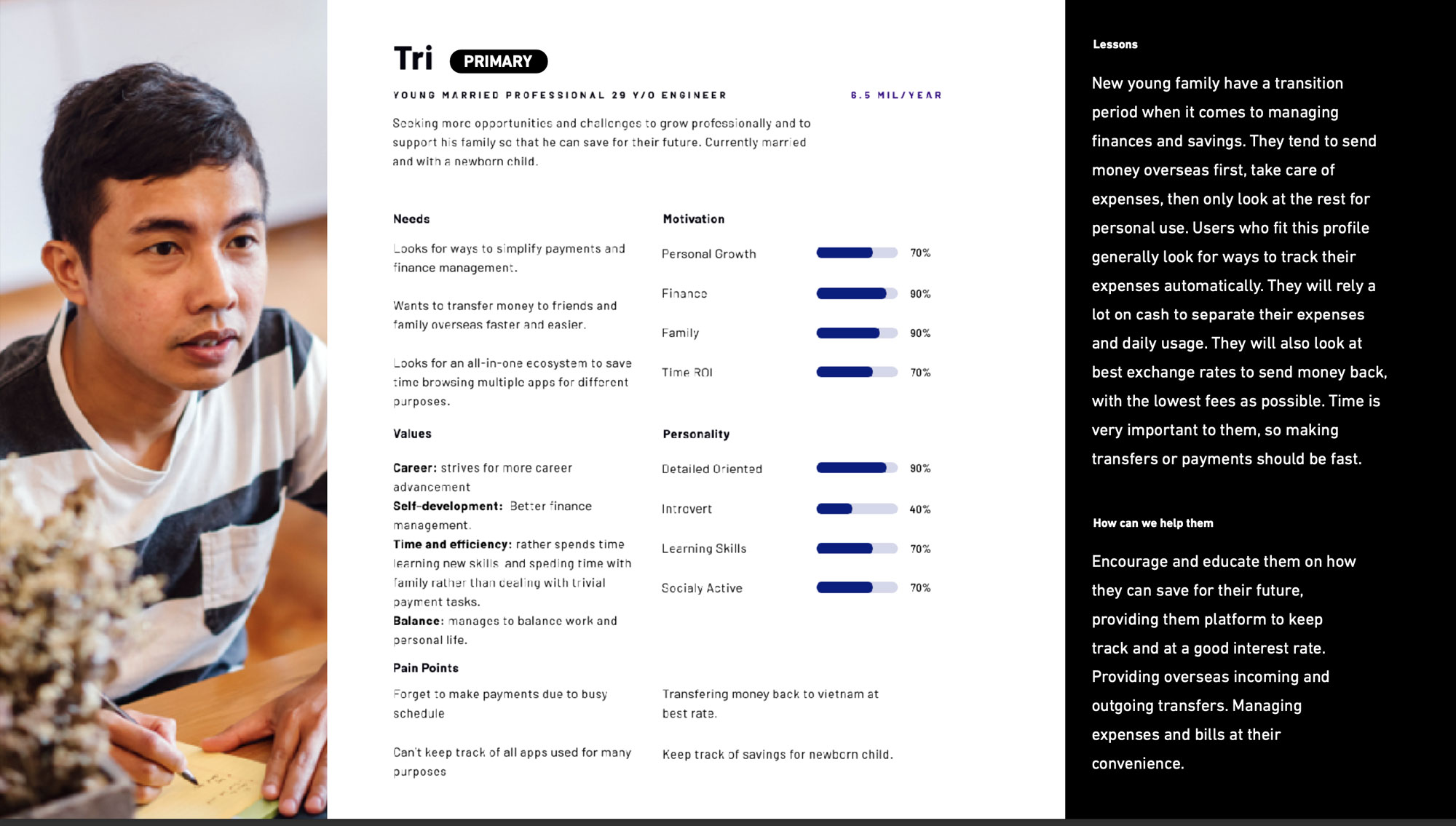

Commencing with a thorough analysis of business requirements, encompassing market research and competitor analysis, we engaged with over 300 users with surveys, and over 40 users with user interviews, with a focus on the largest immigrant populations in Japan, including Vietnamese, Filipinos, and Indonesians.

Early Insights gathered highlighted pain points:

Language Barriers 🔴 🔴 🔴

Many foreigners found the process of opening a bank account and utilizing banking services challenging, primarily due to the language barrier, with most banking processes conducted in Japanese and at bank branch. This leads to a reliance on cash payments for some, as they navigate these challenges.Complicated process and regulations 🔴 🔴 🔴

Users have stated that due to the requirements of their names, creates mismatch with the verification process. Futhermore, regulatory practices in Japan often restrict foreigners to using a cash card and a passbook for banking, limiting their access to banking details to ATM transactions and encouraging a reliance on cash transactions.Cash Society 🟠 🟠 ⚪

The infrastructure in Japan for paying utility bills and other expenses is predominantly cash-based, accessible through convenience stores like 7-Eleven, or via credit card, which foreigners often find difficult to obtain.- Transactions fees 🟠 🟠 ⚪

In Japan, high ATM fees and early bank closures lead foreigners to withdraw significant cash amounts, requiring meticulous budgeting, often using envelopes for different expenses and even allowances for spouse. Lack of Finance Management 🟠 🟠 ⚪

Users are strict with their expenses, rely heavily of setting aside cash to manage their total expenses, and sending money when they can to Vietnam. Whatever is left will not be managed but spent, or very few will place in savings or investments.- Remittance exchange rates and fees 🟠 🟠 ⚪

Vietnamese and Indonesian families often send money overseas, favoring services like DCOM. Users look at the best exchange rates and fees, even if it means using multiple apps or services to get their best outcome. Sometimes they would break their overseas transactions to multiple people so that their fees are lower and get the best tax deduction. Lack of trust 🔴 🔴 🔴

An average of 8/10 people are worried about online security. Some users are hesitant on using unrecognised products and western/english products. Due to the frequent scammers, they heavily rely on friends recommendations or if a products insures that their information is protected.

How can I trust a bank when its so hard for us to open a bank account. I’ve had to ask a Japanese colleague to come with me to the bank before 3pm closing time, to help me fill out all the forms in Japanese.

Truong

Reframing the problem

How might we streamline banking processes for Japan’s foreign workers, making it more accessible and less dependent on cash transactions, while overcoming language and regulatory barriers?

To streamline banking for Japan’s foreign workers, I identified three opportunities that the local market is lacking: creating an inclusive service ecosystem, ensuring seamless registration, and offering an engaging user interface. These enhancements aim to address the gap in providing a more accessible, cash-less banking experience, navigating language and regulatory challenges. Key learnings suggest a move towards personalized, interactive experiences within a comprehensive lifestyle ecosystem, highlighting the need for innovative UI designs while maintaining best UX practices for greater user engagement.

Early Insights of common user motivators:

- Cost Effective 🟢 🟢 🟢

User look at ways to make things cost effective, even if it means using multiple apps, to get the best fees or even just take out cash for the month. - Ease of use 🟢 🟢 🟢

Users look to apps that are easy to use and understandable 24/7 🟠 🟠 ⚪

Users require services available 24/7 as at times they need to send money back in emergency situations.Time Efficient 🟠 🟠 ⚪

Users look to apps that don’t require too many steps to do a particular taskPersonalized Experience 🟢 🟢 🟢

Users appreciate the personalised experiences, especially when it comes to their finances and expenses.Rewards 🟢 🟢 🟢

Some user looks to getting the best rewards, points and cash back to reduce their expenses, even if it mean using multiple app or cards, and following campaigns for the best outcome.

Deeper Insights: Onboarding

Before jumping into the ideation and designs, I had to truly understand the difficult process of opening a banking account first.

Account opening challenges for foreigners in Japan include:

Detail Matching: Foreigners must provide details exactly as on their residence card. This can be complex due to varied naming conventions, such as long names starting with last names for some Vietnamese, or short or single names for Indonesians.

Address Entry: The requirement to enter a full address in Japanese, matching the residence card, poses a significant barrier due to language difficulties.

Katakana Name Requirement: New entrants often lack a Katakana name, which is essential for banking and must match across existing accounts for integration into the payment system.

Phone Number for OTP: Many, particularly Indonesian trainee workers, lack a registered phone number, relying on Wi-Fi for communication, complicating OTP receipt.

Residence Card Stipulations: Eligibility requires a residence card with at least six months before expiry and proof of at least six months’ stay in the country.

Ideate

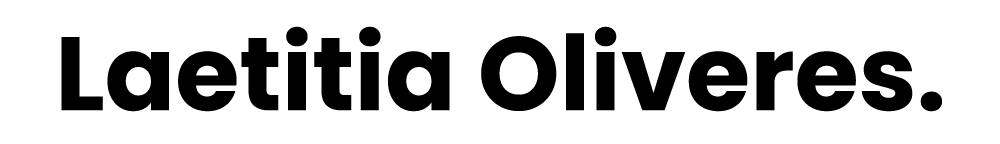

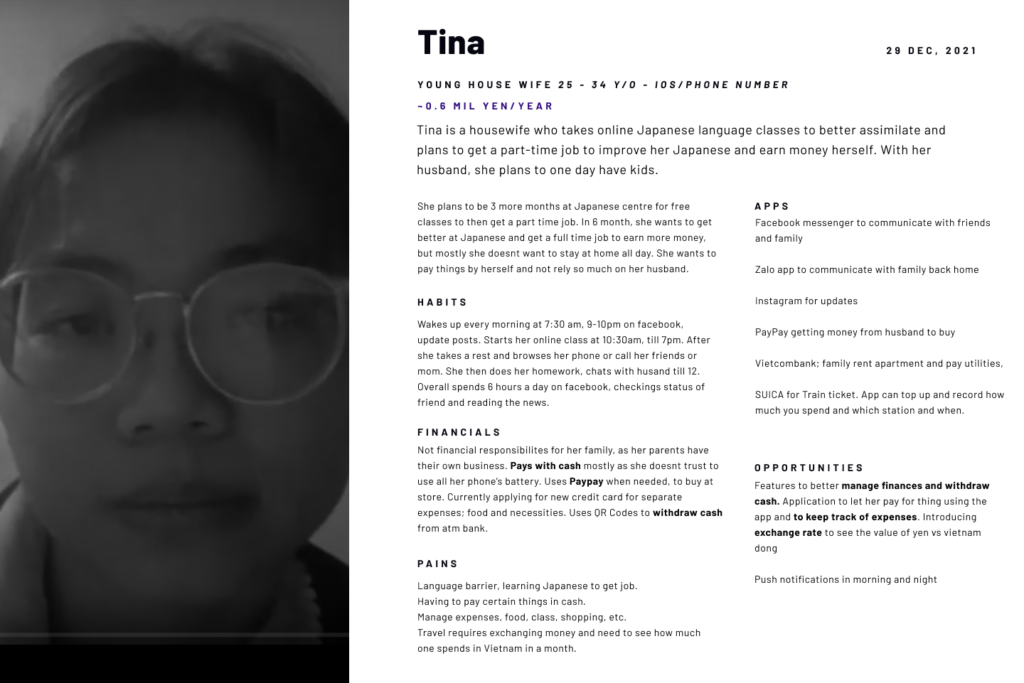

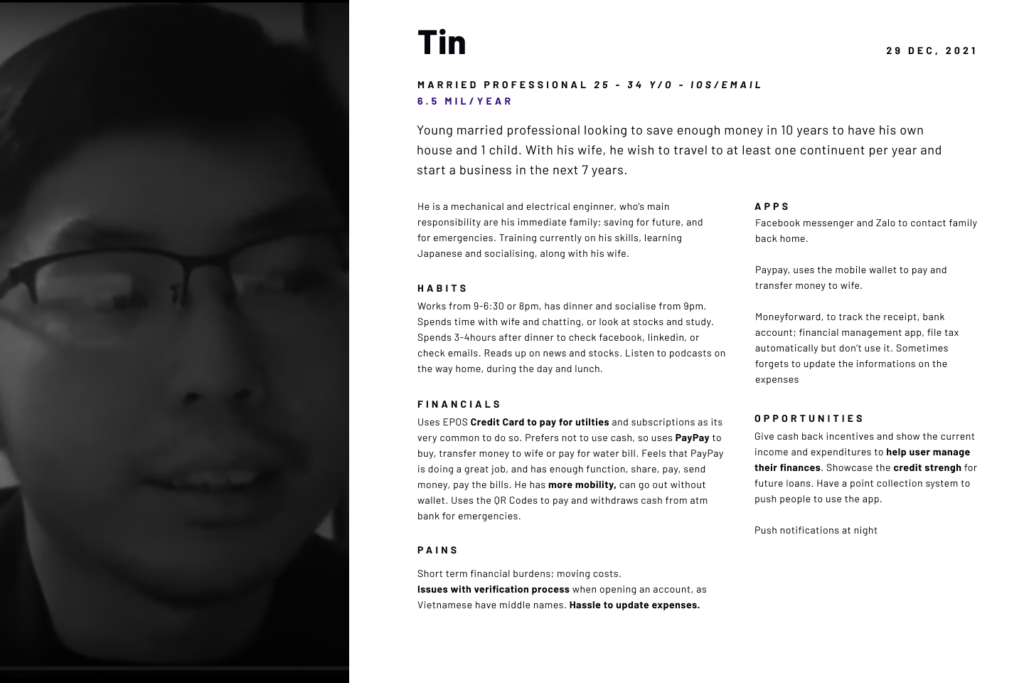

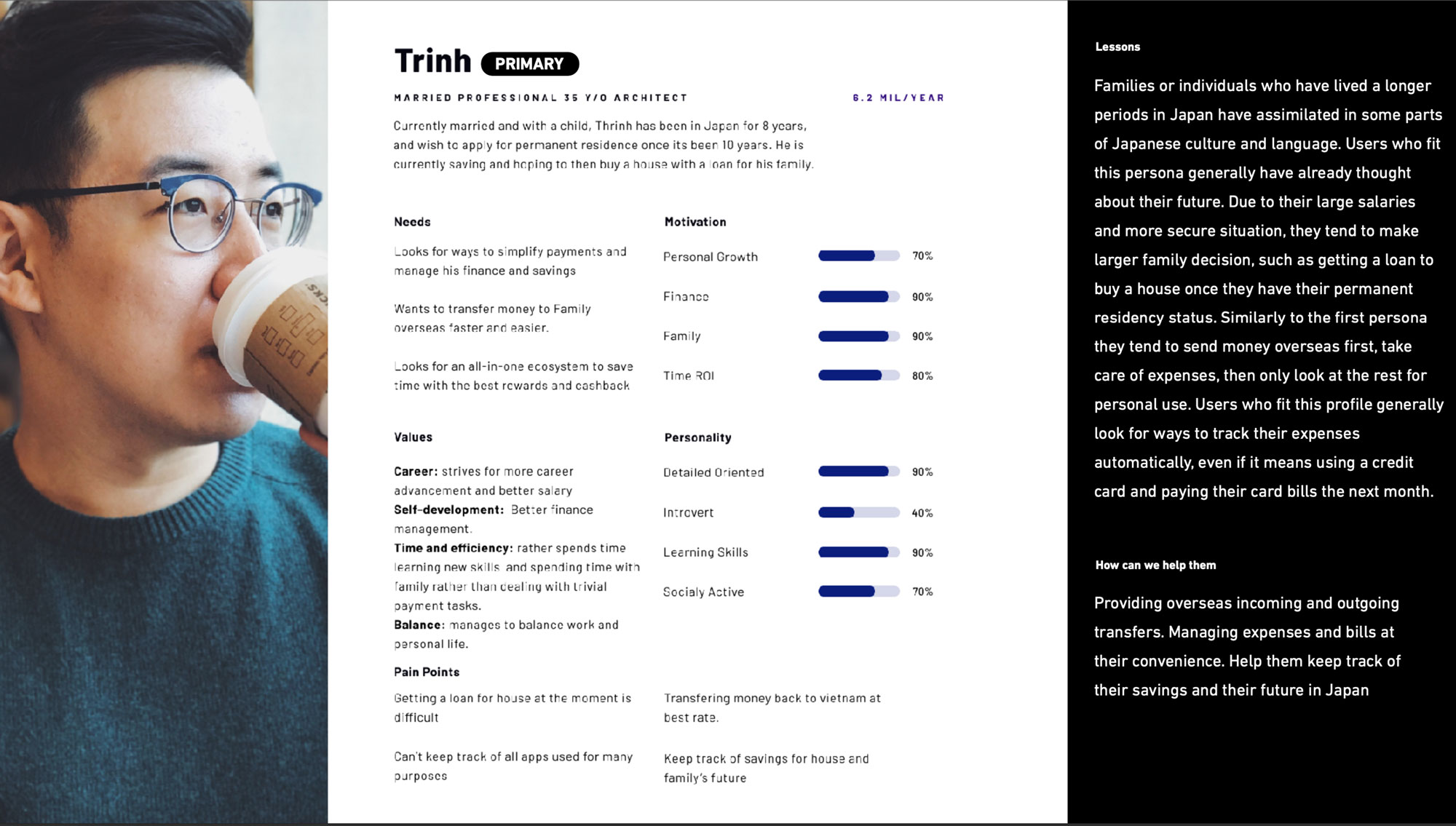

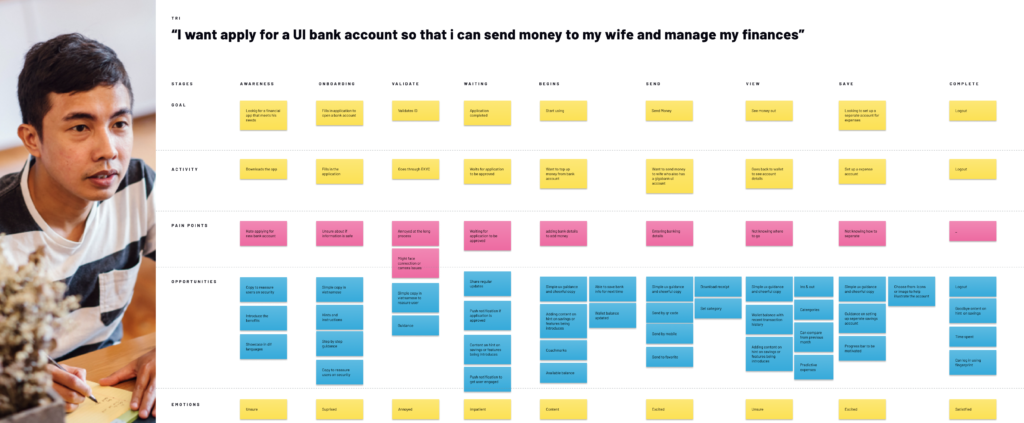

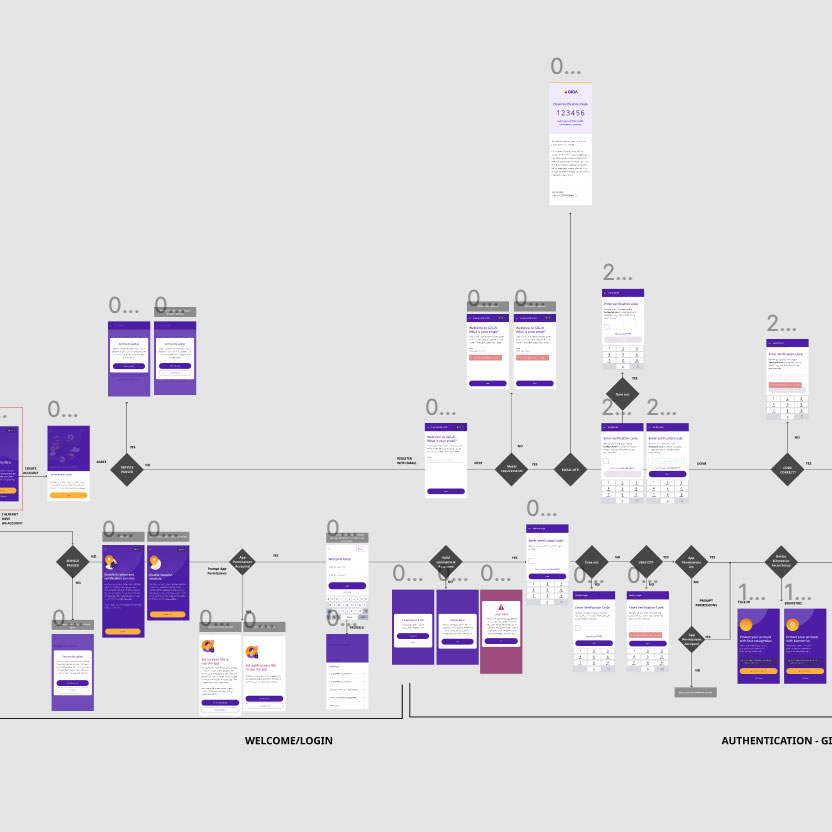

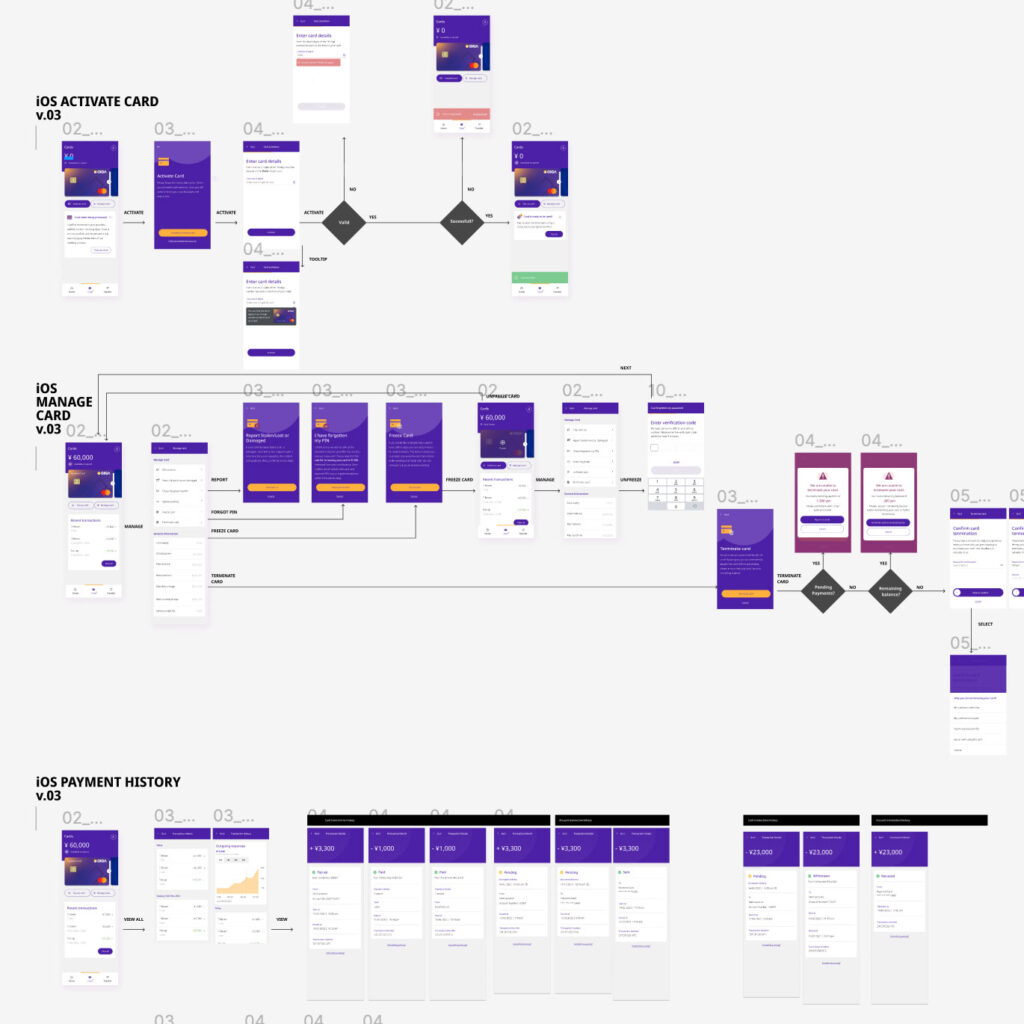

Knowledge in hand, I crafted detailed user personas, journey maps, and flows. A meticulous evaluation of the value proposition set the stage for strategic decision-making.

Along with the founders, stakeholders and product owners, we started to prioritise features and ideating the onboarding funnel. We identified opportunities, and established our processes with the available technology, and api provided by the partner UI bank and verification process by liquid Asia.

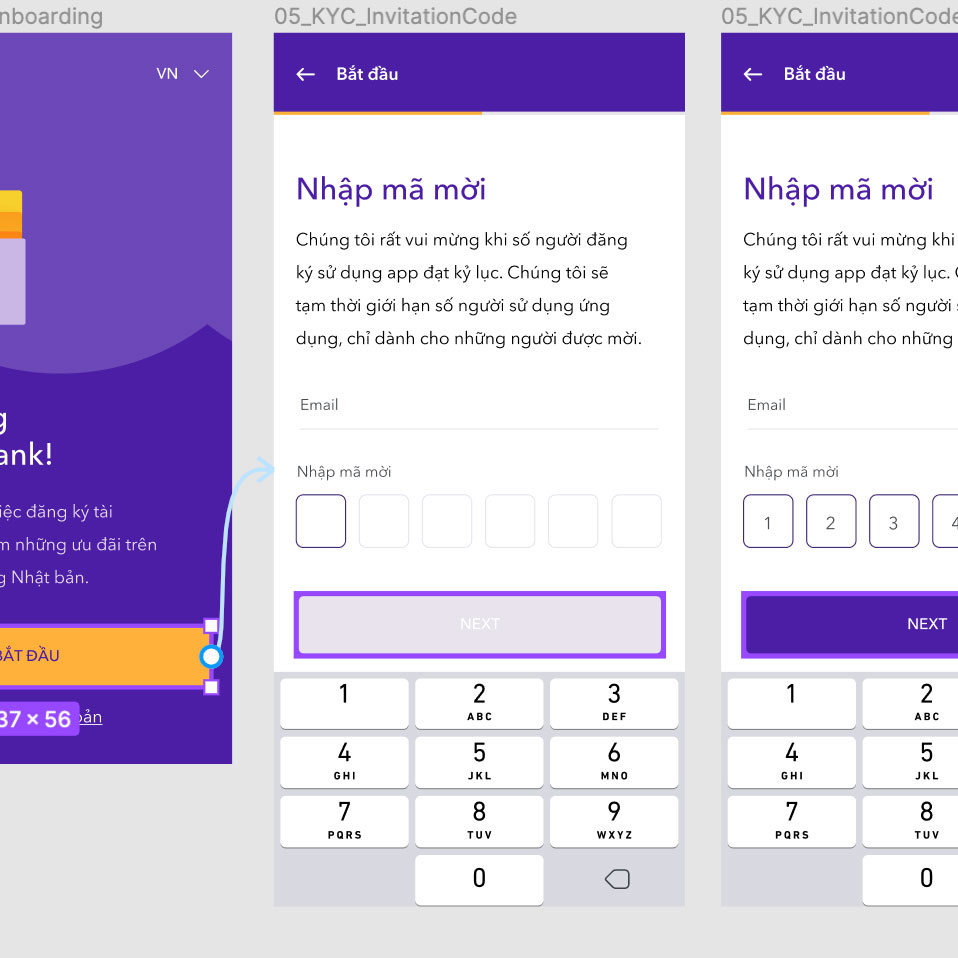

Create & Validate

Leveraging Figma for design, design flows, prototyping, and extensive usability testing in different languages, we validated and refined our innovative solutions.

Build

Seamless Implementation: The critical design handoff to development teams ensured the proper realization of our vision. Establishing a cohesive design system, operating within an agile methodology, and close collaboration with developers allowed for iterative improvements based on continuous user feedback.

Iterative Refinement: Our commitment extended beyond the initial design, with continuous refinement based on customer feedback and data analytics from tools like Mixpanel. With countless hours of customers usability testing, on site and online, user feedback surveys from festival and customer support, data analytics, we could determined the best possible UX, by improving designs, flows, streamlined our processes, and added new features. This iterative approach kept us agile and responsive to evolving user needs.

End Result

Redefined mobile banking for foreign workers in Japan

The result was a mobile app in own language, offering seamless bank account application, user ID verification, balance monitoring, expense tracking, transfers, card payments, and fee-free cash withdrawals—all for a fixed monthly charge. GIG-A stands as a beacon of innovation, providing a comprehensive solution to the unique banking needs of foreign workers in Japan.